Executive Summary

In the fintech industry, real-time data processing is critical for fraud detection, compliance monitoring, high-frequency trading, and AI-driven customer insights. Traditional batch-based financial data pipelines introduce unacceptable delays, leading to financial losses, regulatory fines, and poor user experiences.

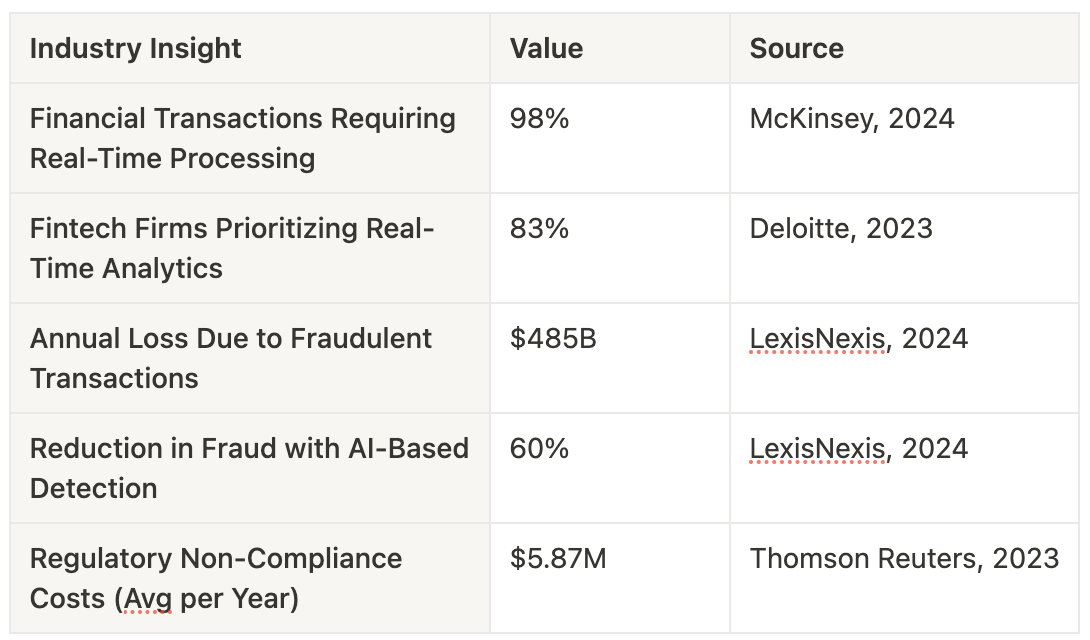

Key Industry Insights:

By implementing real-time data pipelines, fintech companies can:

✅ Prevent fraud before it happens ✅ Deliver AI-powered financial insights instantly

✅ Optimize trading and payment processing with sub-millisecond latency ✅ Ensure regulatory compliance effortlessly

Cut Fraud Losses by 60%—Deploy Real-Time Pipelines Today.

Why Real-Time Data is Critical for Fintech Success

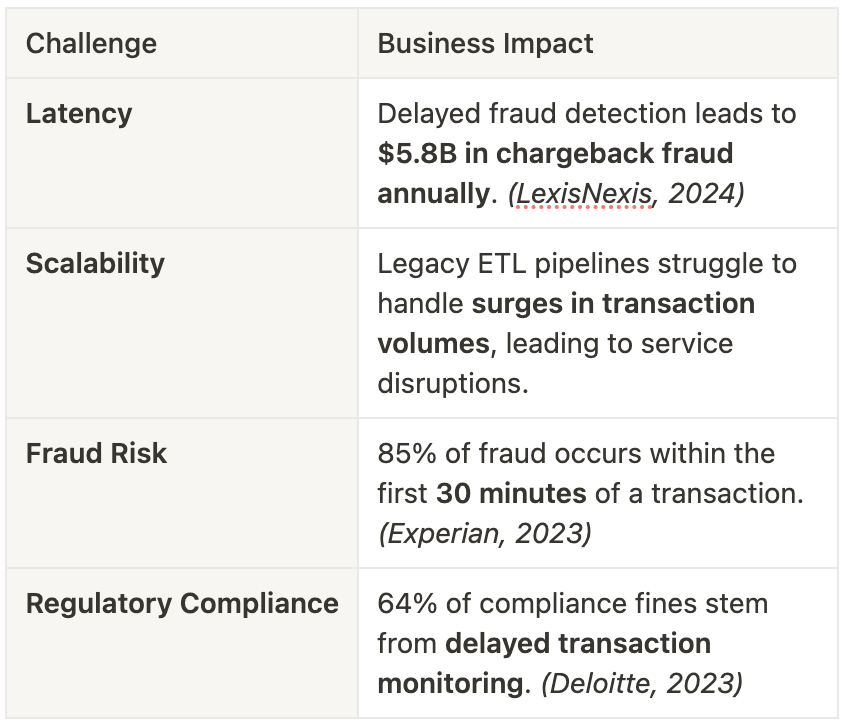

Challenges of Legacy Financial Data Processing

Reduce Compliance Costs with Instant AML & SOX Reporting—Schedule a Demo.

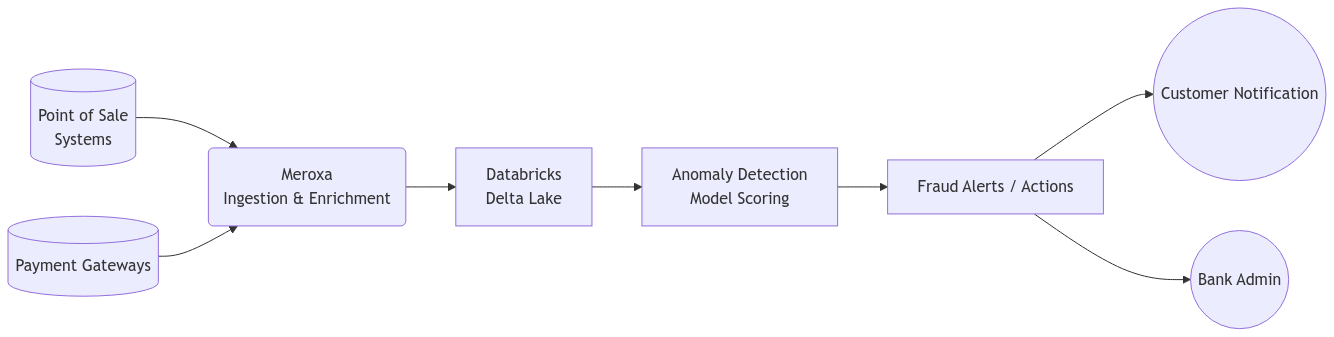

Real-Time Pipeline Architecture for Fintech

Meroxa’s Real-Time Pipeline Architecture, leveraging Databricks, enables fintech companies to process financial transactions instantly. The architecture ingests data from Point-of-Sale (POS) systems and payment gateways, streaming it into Meroxa for real-time enrichment and anomaly detection. The processed data is then stored in Databricks Delta Lake, where AI models analyze transaction patterns, detect fraud, and generate risk scores. Automated fraud prevention and compliance workflows trigger instant alerts and actions, notifying customers, bank administrators, and regulatory teams.

Example flow using Databricks

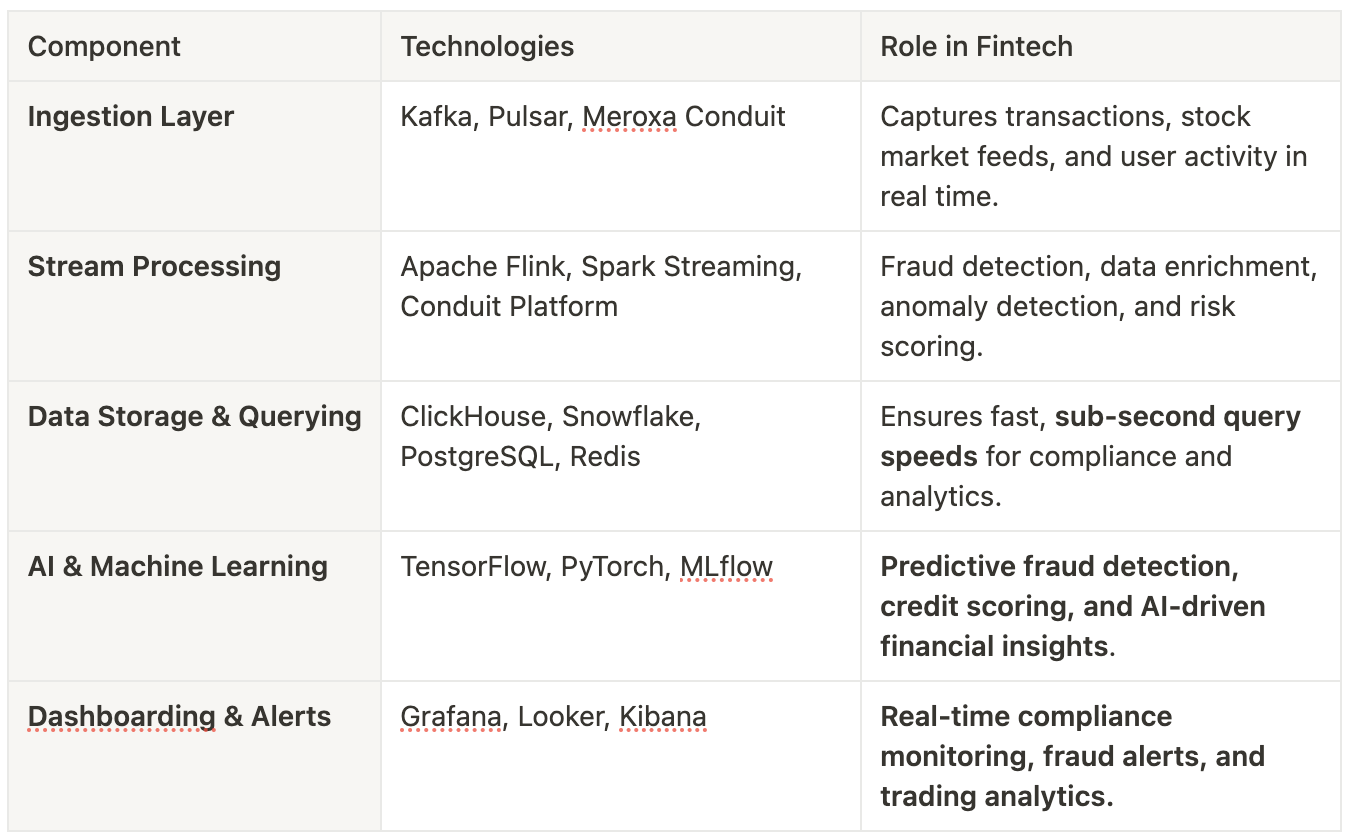

Key Technologies in Modern Fintech Data Pipelines

Modern fintech data pipelines rely on a high-performance technology stack to ensure real-time data ingestion, processing, storage, AI-driven analytics, and compliance monitoring. Ingestion layers like Kafka, Pulsar, and Meroxa Conduit capture financial transactions and user activity instantly. Stream processing engines such as Apache Flink and Spark Streaming enable fraud detection, anomaly detection, and risk scoring in milliseconds. High-speed databases like ClickHouse, Snowflake, and PostgreSQL provide sub-second querying for compliance and analytics, while AI frameworks like TensorFlow and PyTorch power predictive fraud prevention and credit scoring models. Visualization tools like Grafana and Looker deliver real-time alerts and trading insights, ensuring fintech companies stay ahead in an increasingly data-driven industry.

Eliminate Latency in Fraud Detection—Talk to an Expert Today.

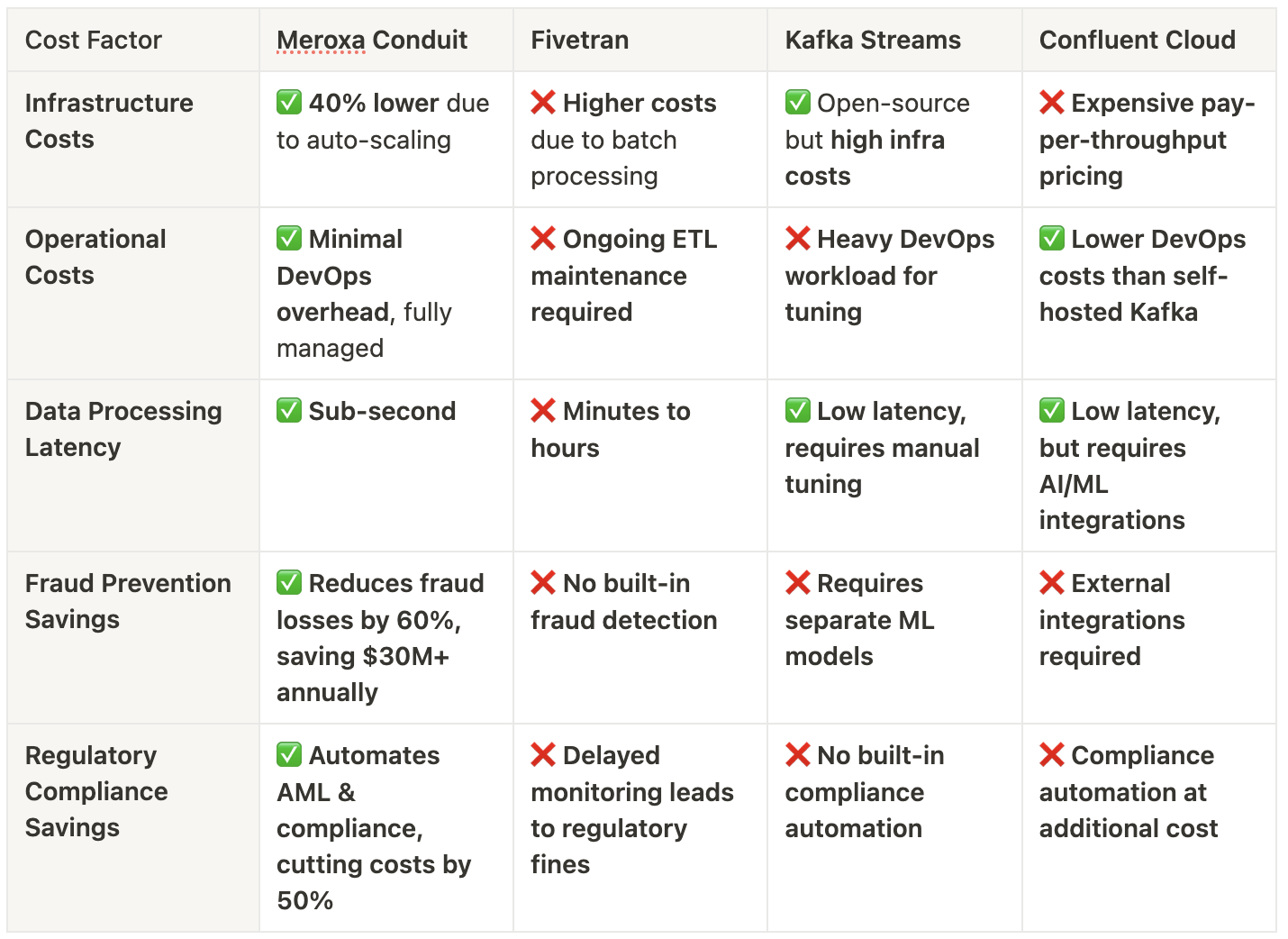

Cost Breakdown: Meroxa's Conduit Platform vs Competitors

When evaluating real-time data pipeline solutions, cost efficiency is critical for fintech companies. Conduit Platform offers a 40% lower infrastructure cost due to its auto-scaling capabilities, eliminating the need for expensive batch processing. Unlike competitors that require manual DevOps management and complex tuning, Meroxa provides a fully managed, low-latency solution with minimal operational overhead.

Optimize Your Fintech Data Stack—Cut Infrastructure & Compliance Costs by 50% with Conduit Platform.

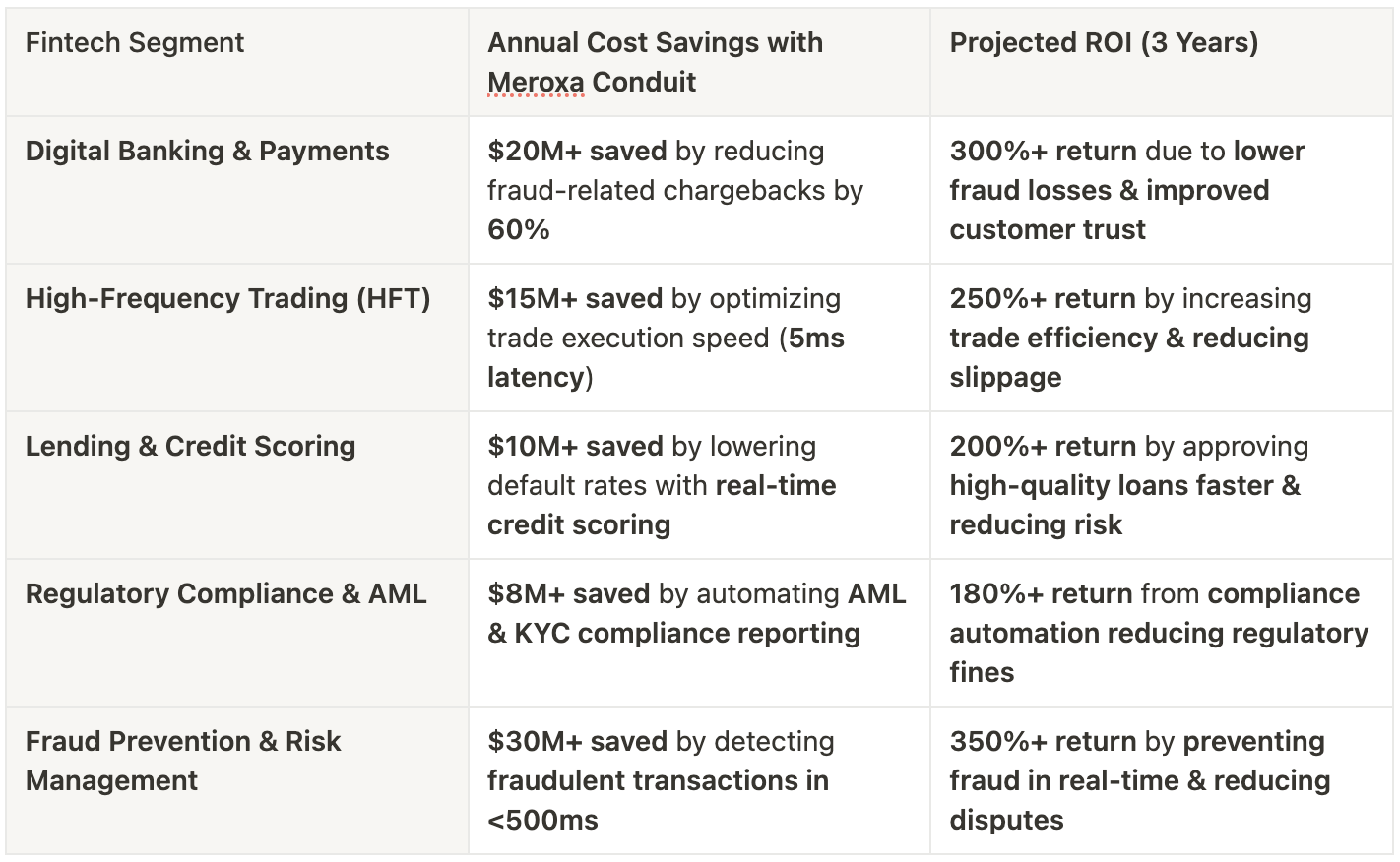

Cost Projections for Different Fintech Segments

Fintech companies across various segments stand to gain significant cost savings and ROI by implementing real-time data pipelines. Digital banking and payments firms can reduce fraud-related chargebacks by 60%, saving over $20M annually, while high-frequency trading platforms can optimize execution speeds to cut slippage costs by $15M+ per year. Lending and credit scoring businesses can lower default rates, leading to $10M in savings, and compliance automation can reduce regulatory fines, saving $8M annually. Fraud prevention and risk management solutions see the biggest impact, with potential savings of $30M+ annually by detecting fraudulent transactions in under 500ms. Across all segments, real-time pipelines deliver high ROI, lower costs, and greater efficiency, making them essential for fintech success.

Projected Cost Savings & ROI by Fintech Segment

All savings are estimations.

All savings are estimations.

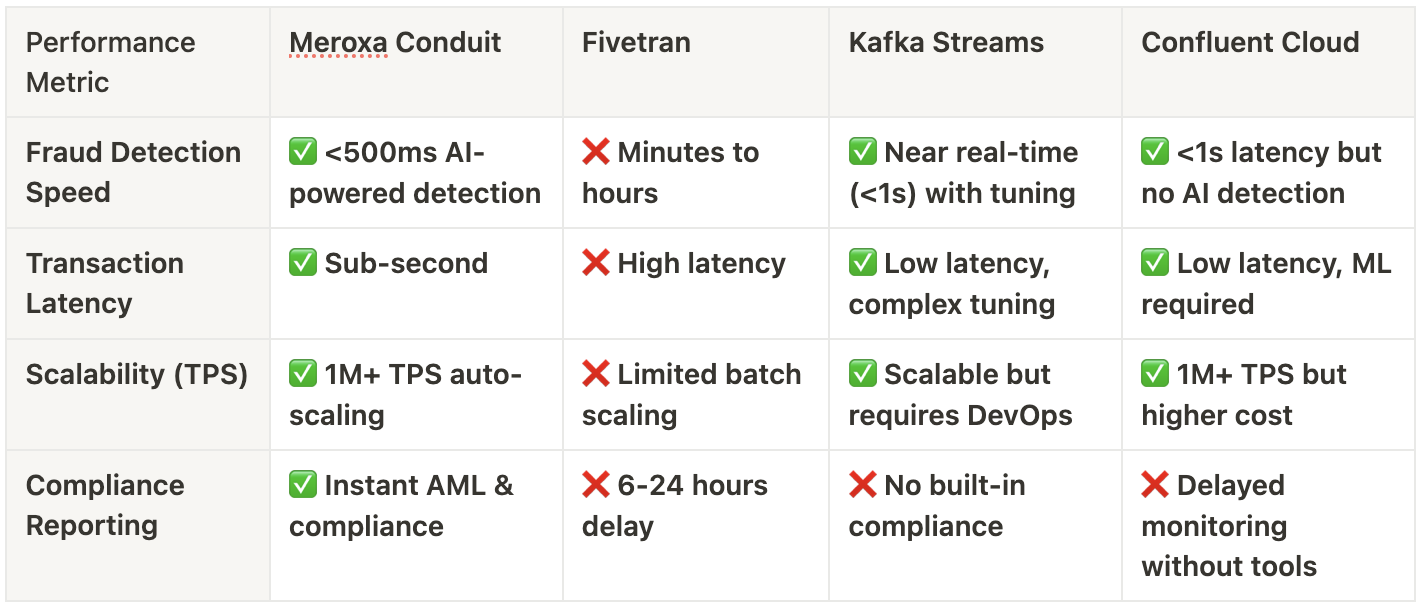

Performance Benchmark: Meroxa's Conduit Platform vs Competitors

When it comes to real-time data performance in fintech, Meroxa's Conduit Platform outpaces competitors with sub-500ms AI-powered fraud detection, sub-second transaction latency, and auto-scaling to handle over 1M TPS (transactions per second). Unlike traditional batch-based solutions that introduce delays, Meroxa ensures instant compliance reporting, seamless fraud prevention, and optimized trading execution. Compared to alternatives like Fivetran, Kafka Streams, and Confluent Cloud, Meroxa delivers lower costs, minimal DevOps overhead, and built-in AI/ML integrations for unmatched efficiency and scalability in financial data processing.

Achieve Sub-500ms Fraud Detection & Real-Time Compliance!

Conclusion & Next Steps

Conduit Platform provides a scalable, low-latency, AI-powered solution designed specifically for fraud prevention, high-frequency trading, credit risk assessment, and compliance automation. With sub-second transaction processing, auto-scaling capabilities, and built-in compliance features, our platform enables fintech CTOs to future-proof their infrastructure, unlock cost savings, and drive long-term business growth.

👉 Request a Demo | Follow us on Twitter, LinkedIn, and YouTube for more insights and updates!